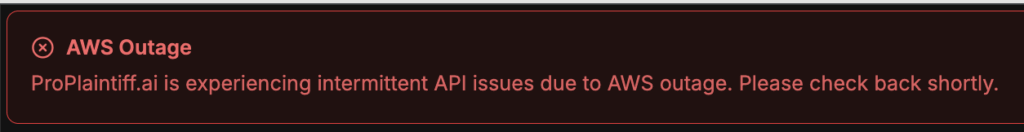

What Today’s AWS Outage Reveals About AI Vulnerability in the Legal World

This morning, thousands of law firms woke up to a problem they couldn’t fix themselves. AWS went down, and with it went practice management systems, document review platforms, client communications, and AI research tools. Lawyers across North America found themselves locked out of the tools they depend on to function.

It wasn’t a cyberattack. No ransomware, no breach. Just a service failure at one of the world’s largest cloud providers. And it exposed how vulnerable the legal profession has become.

The Cloud Dependency No One Wants to Talk About

Most firms don’t realize how much of their infrastructure sits on AWS (or other similar cloud-based infrastructures). Clio runs on it. So does Relativity. Legal AI tools like Harvey and CoCounsel rely on it. Even firms that think they’ve diversified often find their vendors all renting space in the same digital neighborhood.

The concentration is staggering. A single region outage, like today’s disruption in US-EAST-1, can cascade across dozens of legal tech platforms simultaneously. Firms suddenly can’t access case files, billing systems stall, and AI tools stop responding.

The legal profession spent decades building redundancy into physical operations. Multiple office locations. Backup paper files. Off-site storage. Now we’ve handed the keys to systems we don’t control, hosted in places we’ve never seen.

When AI Makes the Problem Worse

AI adoption accelerated this dependency. Most legal AI tools don’t run on your computer. They run on massive cloud servers, processing queries through layers of APIs and remote infrastructure.

When AWS falters, these tools fail. Research platforms that normally return results in seconds go silent. Document analysis workflows freeze mid-process. Automated drafting tools become unusable.

The problem compounds because AI systems are opaque. Your legal research tool calls a vendor API, which calls OpenAI or Anthropic, which runs on AWS compute clusters. You can’t see where the failure happened. You just know nothing works.

Firms running custom AI models face an additional risk. If an outage interrupts training or corrupts processing pipelines, you might need to start over from scratch. Without proper checkpoints and versioning, hours or days of work simply vanishes.

The Business Continuity Blind Spot

Most law firms have disaster recovery plans. They know what to do if ransomware hits or a fire damages the office. But those plans rarely contemplate cloud provider failures.

A cyberattack is different from a service outage. The response protocols differ. The recovery steps diverge. Yet few firms maintain separate playbooks for each scenario.

Consider a typical mid-size litigation practice. Discovery hosted on RelativityOne. Legal research through an AI platform. Client billing on Clio. Case management in the cloud. When the cloud goes down, every critical function stops simultaneously.

Partners scramble for workarounds. Staff can’t access documents. Deadlines loom. Clients call asking for updates. And there’s nothing the firm’s IT team can do except wait for Amazon to fix whatever broke.

The risk isn’t theoretical. It happened today. It will happen again.

What Resilient Firms Do Differently

Some firms saw this coming and prepared. They understand that convenience without redundancy is just vulnerability with better marketing.

Resilient firms maintain local copies of active matters. Not everything, but enough to keep operating during an outage. Case files for upcoming hearings. Documents being actively worked on. Critical client information.

They test their backup systems regularly. Not once when they’re installed, but quarterly or annually. They know whether failover actually works because they’ve tried it under controlled conditions.

They’ve mapped their dependencies. They know which vendors rely on AWS and whether those vendors have their own backup infrastructure. They’ve asked uncomfortable questions about single points of failure.

They’ve negotiated service level agreements with teeth. Clear commitments about maximum downtime. Specific remedies when outages occur. Financial consequences that make vendors prioritize reliability.

The Multi-Cloud Strategy

Spreading risk across providers sounds simple. In practice, it’s expensive and complex.

Running parallel systems on AWS, Google Cloud, and Azure can double or triple infrastructure costs. Data synchronization becomes a challenge. Staff need training on multiple platforms. Security protocols multiply.

But the math still favors diversification. One day of lost productivity for 100 lawyers billing $500 per hour costs $400,000. Multi-cloud failover infrastructure might run $30,000 annually. The business case practically makes itself.

Geographic redundancy matters too. If your primary systems and backups both sit in the same AWS region, they share the same failure point. Replicating across different regions, or better yet different providers, offers real protection.

Canadian firms face an additional wrinkle. Data sovereignty rules under PIPEDA mean you can’t always fail over to US servers during emergencies. The choice becomes uptime versus compliance, and neither option is good.

The Questions Every Managing Partner Should Ask

Before the next outage, someone in leadership needs to answer these questions clearly:

What cloud providers host our critical systems?

Are they concentrated in a single region or provider?

What happens to our data if a vendor goes offline for 24 hours?

Do we test our backup systems, or just assume they’ll work?

Where are our data replicas physically located?

What manual workflows can we activate within one hour?

Do our vendor contracts address prolonged downtime?

Who communicates with clients when systems fail?

How quickly could we redeploy key AI tools to a different platform?

Do we maintain local copies of matters approaching deadlines?

If you can’t answer more than half of these confidently, your firm is exposed.

The Insurance Gap

Traditional legal malpractice insurance doesn’t contemplate cloud outages. Policies cover negligent errors by lawyers, not service failures by technology vendors.

Some firms assume cyber liability insurance fills the gap. It doesn’t, at least not cleanly. Cyber policies address breaches and attacks, not infrastructure failures.

Business interruption insurance might help, but coverage terms vary wildly. Many policies exclude technology service disruptions or cap payouts at levels that don’t reflect true exposure.

The insurance industry is slowly catching up. Some carriers now offer technology-interruption riders. Others ask detailed questions about cloud dependency during underwriting. But comprehensive coverage remains rare and expensive.

Firms should review their policies now, before an outage causes real harm. Understanding what’s covered and what isn’t helps with risk planning. Hoping for the best is not a strategy.

The Human Fallback Problem

Automation breeds dependency. Younger associates have never researched cases without AI assistance. Staff assume billing systems will always be available. Nobody keeps printed copies of anything anymore.

When systems fail, people freeze. They don’t know how to fall back to manual processes because they’ve never had to.

This isn’t a criticism. It’s human nature. Skills atrophy without use. But it creates risk. A firm that can’t function without its technology isn’t resilient.

Maintaining human fallback capacity means keeping staff proficient in manual workflows. It means documenting procedures for operating without key systems. It means accepting that some redundancy looks inefficient until the moment it becomes essential.

The goal isn’t to work without technology. It’s to work when technology fails.

What Clients Will Start Demanding

Corporate clients already ask detailed questions about cybersecurity. They require outside counsel to maintain specific protections and protocols. They audit compliance.

Cloud resilience will be next. Sophisticated clients will want to know where their data is stored, whether backups exist, and what happens during extended outages. They’ll include operational resilience requirements in outside counsel guidelines.

Some will prohibit certain high-risk configurations. Others will demand transparency about vendor dependencies. A few will require proof of tested disaster recovery capabilities.

Consumer clients present different challenges. Most lack the sophistication to ask the right questions. But they’ll judge firms harshly when systems fail at critical moments. Trust erodes quickly when a firm can’t deliver basic services because its cloud provider had a bad day.

The Regulatory Response Coming

Regulators are watching. After previous major outages, UK and EU authorities began exploring oversight frameworks for cloud providers. They’re treating major vendors like systemically important infrastructure.

North American regulators will follow. Law societies and bar associations may eventually require firms using cloud-based systems to demonstrate operational resilience. The requirements will mirror those imposed on financial institutions.

Compliance burdens will increase. Firms will need documented continuity plans, tested failover procedures, and evidence of vendor due diligence. Those that prepared early will sail through. Those that ignored the risk will scramble.

Professional liability will evolve too. If a firm misses a filing deadline because its cloud provider went down, is that malpractice? Courts haven’t decided yet. But the first few cases will set precedents that define the standard of care for decades.

Building Governance That Actually Works

Resilience requires governance, not just technology. Someone needs to own the risk. Processes need to exist before crises hit.

Start with vendor due diligence. Review terms of service carefully. Understand where data lives and how long recovery takes. Require service level agreements that include meaningful remedies for extended outages.

Establish monitoring and alerting. Subscribe to status feeds from major providers. Integrate alerts into IT dashboards. Train staff on escalation procedures so response happens immediately, not after someone notices something is wrong.

Create communication protocols. When systems go down, clients need to hear from you quickly. Silence breeds panic. A clear message explaining what happened, what you’re doing, and when you expect resolution builds trust even during failures.

Document everything. Map dependencies. Track which systems rely on which vendors. Maintain updated inventories of where data is stored and how to access it manually if needed.

Test regularly. Disaster recovery plans that sit on shelves gathering dust don’t work. Run drills. Simulate outages. Find weaknesses in controlled conditions rather than during real emergencies.

The Graceful Degradation Principle

Systems should fail softly, not catastrophically. When primary tools become unavailable, something should still work.

An AI document review platform might fall back to a simpler local model that handles only the most urgent cases. Automated drafting tools could default to templates and human-assisted completion. Case management might revert to spreadsheets and shared drives.

Perfect is the enemy of good enough during an outage. The goal isn’t maintaining full functionality. It’s providing enough capability to meet deadlines and serve clients while primary systems recover.

Designing for graceful degradation requires thinking through failure modes in advance. What’s the minimum viable operation? What can be done locally versus remotely? What manual processes need to remain available?

Firms that answer these questions before crises hit can pivot smoothly. Those that don’t face chaos.

The Philosophical Tension

Law is fundamentally a human judgment profession. It requires wisdom, discretion, and accountability. Yet we’ve increasingly delegated critical functions to machines we neither own nor control.

The efficiency gains are real. AI helps lawyers deliver better work faster. Cloud platforms enable collaboration and remote work. Modern practice management systems streamline operations.

But convenience created vulnerability. We optimized for productivity and forgot about resilience. We embraced innovation without considering failure modes.

The path forward isn’t rejecting technology. It’s designing systems that can breathe without constant external support. Local inference capabilities. Regional data pods. Modular tools that can swap between providers seamlessly.

The future of legal AI isn’t everything in the cloud. It’s cloud plus sovereign redundancy. Firms that build that architecture now will own the market for operational trust.

The Bottom Line

Today’s AWS outage will fade from headlines quickly. But its lessons should persist.

Law firms operate in an industry where credibility rests on precision, reliability, and confidentiality. Dependency on any single technology provider contradicts those values.

AI has given lawyers incredible power. The ability to analyze faster, draft cleaner, and deliver more value. But power without resilience is just risk with a better interface.

The firms that treat cloud resilience as core professional competence, not an afterthought, will thrive. They won’t just survive the next outage. They’ll define what technological trust means in modern legal practice.

Because when the cloud goes dark, the firms that kept the lights on will be the ones clients remember.